Update(1): We added an interactive map updated daily that shows current dynamics of the transportation industry vs. reference period (second part of January 2020) in mileage traveled by vehicles in each particular country. Feel free to check it yourself and make own conclusions.

Update(2): Just in two weeks the situation changed into much more negative scenario than I initially expected. To counter-act we launched special covid19 rescue campaign.

The world will never be the same as it was five months ago. No doubt 2020-2022 will be known in history as the years of the massive countries' isolation processes due to coronavirus with a huge impact on the economic situation. As a person deeply involved in the GPS tracking and fleet management industry for the last 15 years I’m very curious about the impact these processes may have on my industry.

Disclaimer: I’m in no way related to analysts, financial experts or economists. I’m a technical guy who in these 15 years has been able to grow a great company that started with three enthusiasts back then and is now uniting 200+ employers and delivering its product in 130+ countries. The opinion shared here is very subjective and personal. Whenever you have any desire to argue — you are welcome to this forum thread.

So the general rule is that there are no global processes. Each country’s economy is unique and due to local peculiarities, the situation e.g. in the USA can and should be totally different from that in China, Italy or Mexico. But let’s think globally.

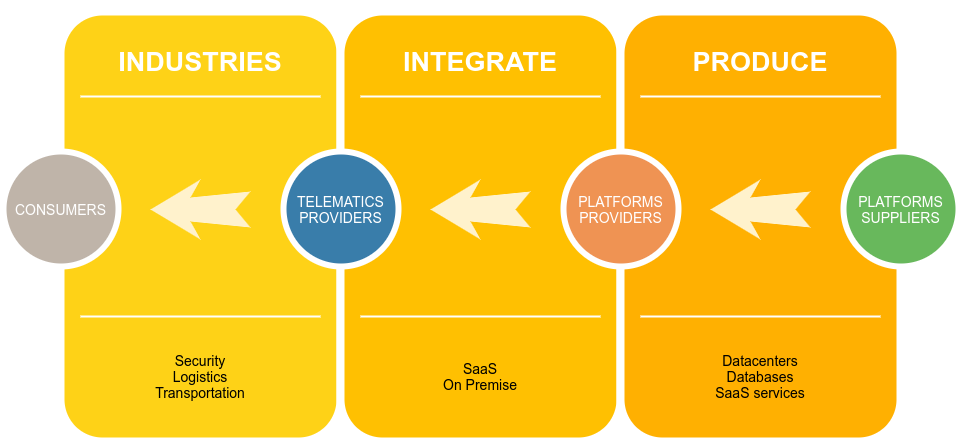

Structure of GPS tracking industry

Let’s look at how GPS tracking and fleet management business (its software part) is organized:

Consumers — end users for the telematics service. They are directly or indirectly using telematics services to optimize the operations of their business.

Telematics Service Providers (TSP) — companies that buy GPS tracking devices, buy GPRS connectivity, buy or rent a platform and combine all these components into a holistic solution adapted to the needs of a particular consumer.

Platform providers — these are global companies, like Gurtam, specialized in delivering adaptable software for TSPs.

Platform suppliers — the suppliers of software and hardware components used by platform providers to create their platforms.

Here I focused only on the software part of the industry. I’m not involved in GPS tracking hardware business or in connectivity services and can not argue about these segments even though they are tightly related to each other especially for TSP operations.

Global trends triggered by the coronavirus

So in general what we can expect? First of all, let’s look at the global processes. There are a few interesting trends growing worldwide:

Offline activities (marketing) involving people gathering are being canceled. This is due to panic, but the impact is huge. Exhibitions, concerts, marathons, conferences, and other massive events — everything is now being canceled or postponed. A lot of businesses involved in these operations — like booth construction, events grounds, etc. are going to be bankrupt this or next year.

People are canceling their travel activities. Business trips and recreation activities are now being paused. This heavily affects the airlines (a lot of flights are now being canceled), but what even worse, it impacts the country-wide economy of popular recreational destinations.

Supply chain problems in manufacturing. This is not a secret that most low-level components nowadays are manufactured in China. At the same time, China shuts down factories and isolates a lot of people and cities to prevent coronavirus from spreading — that immediately affected manufacturing processes across the globe.

Oil prices are falling. Yes, the oil price and thus the price for its subproducts will fall. The lower the oil price, the less sense there is to prevent fuel thefts.

Investment rate decreased, loans are expensive. Everybody knows that the crisis is coming and thus investors are holding the money. It means that the need for money is now growing and many cool startup ventures and small- and medium-sized companies are in a risky position due to the lack of financing for business development.

Businesses are spending the marketing budget online. Yes, the online marketing industry should grow, as people are always online — working, chatting, commuting, entertaining, etc. — businesses have countless ways to pop up in front of your eyes. Video streaming and game industries are also subject to growth. But they are not related in any way to the GPS tracking industry and thus not interesting for us.

Collaboration IT tools are of great demand. Yes, now people want to work remotely and thus they need more collaboration tools like video conferencing, project management and documentation systems, and so on.

Growing demand for computers and server hardware. As more and more people are going online, internet services need more and more hardware to operate.

As you may see from these global trends their impact on our industry is different. The first thing to notice is that all the money that our industry (fleet management) receives is located in the pockets of consumers. And our consumers are somehow related to the transportation industry that has own controversial trends:

People transportation is decreasing, quite fast. Primarily due to factory closures and because no-one wants to catch coronavirus in the bus. This part of the industry is stagnating.

Goods transportation is falling due to the global economic situation. This is obvious — fewer goods are being used, fewer goods are manufactured, and, consequently, fewer goods are transported.

Delivery services are in high demand. Yes, this part of the transportation industry should skyrocket. Together with online shops now it is much better to order something online in order to skip the visit to the shop. And this will positively push the delivery services industry along with the demand for the tools and services to control delivery and make it more effective.

From uncertainty to opportunity

How to count the impact of the global economic slowdown on us? Looking back at the financial crisis in 2008-2009 I have no clear picture. For Gurtam that was a period of rapid growth and what we noticed is that the crisis itself generated a lot of attention to the Telematics Service Providers (TSP) business. At that time GPS tracking was an emerging technology and the competition rate between TSP was quite low. In 2008 we grew 300% compared to 2007 followed by 200% in 2009. So far I can only conclude that we had some impact that was feasible in the second year of the crisis. Probably the same we will have now — not too much different in 2020, but prepare for problems in 2021. This is what history says.

There are a couple of problems we may already notice this year. They are related to the problems with the supply chain due to factories shutdowns in China. We are affected by the lack of computer hardware components and in that case, need to deliver even more efficient software in terms of CPU/RAM/IOPS operations — and here flespi is in the best position due to its initial choice to stick to very low-level technologies under the hood.

Another problem line comes from GPS tracking manufacturers — most of them are located in China and even those outside China still use components from China to offer competitive prices. It means that TSPs may soon have problems with insufficient GPS devices for installations. But this should have just a short-term impact because Chinese components manufacturers should soon resume their operations.

Concerning countries — those countries that have their GDP based on tourism will be greatly affected this year. All other countries should overcome it soon or less.

The need for transportation will be here at all times. This is a basic need, like toilet paper and food. Fewer connections mean more and more delivery services and all this information should be structured to effectively manage the fleets. And TSP business is doing exactly this — digitalizing the information about the fleet operations.

Of course, the market for new cars will collapse for a couple of years. But at the same time let's look at this as an opportunity — for GPS tracker manufacturers there is no more need to compete with built-in devices installed by the car manufacturers. You may even earn more from service than from the installation itself. Just think about how to make it right.

Personally I think that these will be interesting years. The time of changes, the time for new opportunities, the time when real manufacturers will grow in value, the time when great engineering solutions and technologies will be really helpful, the time when the price of money will grow and easy money flows (e.g. earned on stock exchanges) will finally disappear.

So keep your fingers crossed and prepare to work much harder than in previous years. And everything will be great!