New year, new heights… :) Compared to the previous year, in 2024, we got more than 300k devices connected from 100+ GPS tracker manufacturers. The news about hitting the 1-million-devices club was a moment of fame. Don’t blame us for repeating it — it genuinely reflects your contribution. But it’s not just about the absolute numbers; the trends behind them are far more exciting.

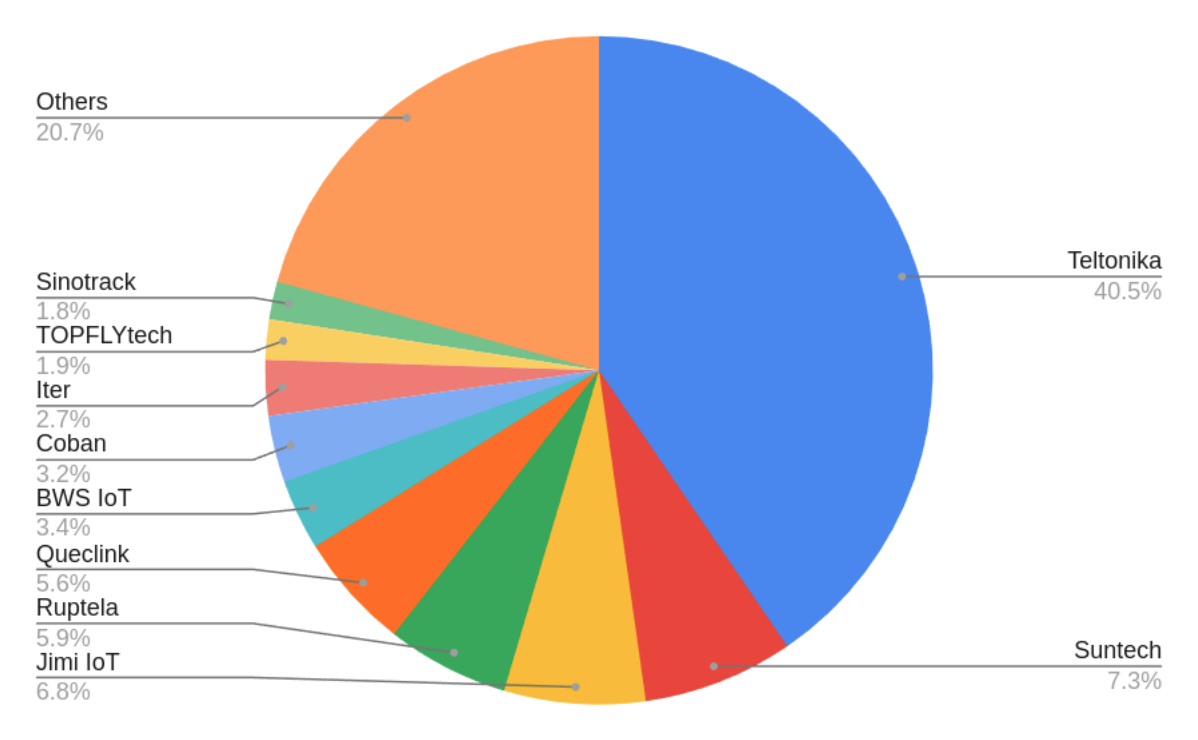

While in 2023, the top ten brands collectively accounted for ~90% of the total, this year’s stats show their share dropped to nearly 80%. What does this mean? New companies are carving their way into the rankings, which signals intensifying competition. At the same time, it’s a clear indication that the telematics market still has room for both collaboration and innovation.

So, let’s analyze the list, examining their YoY growth ratios to see how fast they’ve been scaling compared to the 2023 dynamics — and even back to 2022 — for a fuller picture.

Disclaimer: This rating is based on our internal data and isn’t meant to provide a fully objective reflection of the telematics equipment market. However, it offers valuable insights for our clients — especially technology and IT companies aiming to develop advanced telematics and IoT solutions.

10. Sinotrack

Most popular models:

Sinotrack added approx. 5,500 devices this year, showing a 79% YoY growth. However, compared to the explosive 172% growth in 2023 and 231% in 2022, the dynamics have clearly slowed. With nearly 18,000 connected units in total, the company continues to make its mark, while the list of “most popular” devices is gradually expanding. That said, there hasn’t been much in the way of groundbreaking marketing news. Nevertheless, Sinotrack frequently appeared in our monthly rankings, proving it’s not backing down. For sheer perseverance, let’s give them the “Determination Award.”

9. TOPFLYtech

Most popular models:

TOPFLYtech added almost 6,000 devices this year, compared to approximately 7,000 in 2023, resulting in an 83% YoY growth (121% achieved last year). This might suggest a slowdown, although the company now has around 19,000 connected units in total, with the same two models still leading the charts.

The media highlights the company's focus on real-time asset tracking solutions (e.g., TorchX 100) while strengthening multi-region compatibility. The company also secured several certifications required for Europe, Saudi Arabia, and Brazil, effectively leaving no market behind. There’s no doubt that TOPFLYtech is ambitious and capable of much more.

8. Iter

(A newcomer in our ranking)

Most popular model:

iTR120 +4106

Iter confidently debuts at 8th place, adding an impressive ~8,000 devices this year. The iTR120 appears to be an ideal combination of practicality, affordability, and reliability, making it a go-to solution for those seeking efficient and secure vehicle tracking. We’re eager to see if Iter continues this momentum in the next ranking.

7. Coban

Most popular models:

Coban has surprisingly dropped to 7th place, despite once being a firm top-three leader. The company added ~9,800 devices but is seeing a steady decline in growth, with 47% YoY growth the last year, 46% in 2022, and a still insufficient 73% in 2023. Known for its affordable GPS trackers, Coban has ~120,000 units in total, so it remains popular far beyond, but the lack of new model launches and slower adoption rates suggest the company needs to act fast to reclaim its position. Let’s see what 2025 holds for them.

6. BWS IoT

(The second newcomer in our ranking, most popular model: unspecified)

BWS IoT made an impressive entry. Specializing in advanced telematics for logistics and fleet management, the company added ~10,000 devices. With 2.5 million devices in the market, they claim to be “the fastest-growing tracking company in Brazil.” Add to this their strategic partnership with SIMCom for innovative LTE and LPWA solutions, and it’s clear this ranking is no coincidence.

5. Queclink

(Ranked 6th in 2023, 3rd in 2022)

Most popular models:

The manufacturer grew by ~17,000 devices this year, achieving an impressive 135% YoY growth, bouncing back from 63% in 2023 and an even 100% in 2022. With ~70,000 connected units, Queclink is an excellent example of diversification at work, the list above includes a moto tracker, asset tracker, and classic vehicle one. They’ve also introduced new models like the GV850/GV851, customizable Linux-based telematics gateways; the GL601, a solar-powered, maintenance-free container tracker; and the WR210LG, an industrial-grade router. These innovations are likely to boost their growth further in the next round.

4. Ruptela

(Ranked 4th in 2023, 5th in 2022)

Most popular models:

I’d nominate this company for the "Steady Growth" award after adding ~18,000 devices last year, achieving an impressive 130% YoY growth — higher than the 103% growth seen in 2023 and far surpassing 57% in 2022. The company now boasts over 68,000 connected units in total. This Lithuanian company introduced Plug5, offering enhanced compatibility with electric vehicles, also expanded its Eco 5 family and introduced the CustomCAN feature in its HCV5 Lite and Pro5 Lite devices. I believe they’re poised to climb even higher in the rankings for the next year. Staying in 4th place likely feels unsatisfying for a company with such strong tacho expertise and historical prominence in Europe, and we might see another tactical push to reach the top tier.

3. Jimi IoT (Concox)

(Ranked 5th in 2023, 4th in 2022)

Most popular models:

Jimi IoT confidently climbed to 3rd place, adding more than 20,000 devices and achieving an impressive YoY growth of 155%, far outpacing the 85% growth recorded in 2023 and humble 31% in 2022. With nearly 100,000 connected units in total, the company showcases resilience and renewed momentum.

As for their models, while WeTrack2 no longer appears on the list, other models are gaining traction — though they still have a long way to match the popularity of GT06N. In 2024, Jimi IoT proudly launched its latest innovation in vehicle telematics: the VL110C LTE Vehicle Terminal, a state-of-the-art tracker tailored for managing vehicles across various industries. That was a significant milestone for it was their first device equipped with GNSS/LTE Jamming Detection.

2. Suntech

(Ranked 3rd in 2023, 10th in 2022)

Most popular model:

ST310U: +21,532

Suntech counted more than 22,000 devices last year, achieving 111% YoY growth (compared to 578% in 2023 and 71% in 2022), and now has over 50,000 connected units. Two years ago, they were just entering the rankings, but they’ve since built a solid presence. Looks like the company continues to invest in marketing and sales, maintaining its network in South America and eyeing opportunities further to become a reliable hardware supplier in the region.

1. Teltonika

Most popular models:

Teltonika remains at the top, adding a staggering ~123,000 devices and achieving 144% YoY growth — a significant leap from 89% in 2023 (and a very successful 2022 with 230%). With more than 345,000 connected units, Teltonika continues to set the standard in telematics. The company launched 22 new devices last year, including upgrades to its FMx250 series. With teams in 26 countries and 5 new offices opening worldwide, Teltonika’s dominance shows no signs of slowing down.

Summing Up

On the pie chart below, you can see what share each of the top 10 brands constitutes in the overall devices' growth:

This year’s ranking shows consistent growth among the top five manufacturers, while the lower half reflects either slowed growth or the rise of newer competitors. Companies like TOPFLYtech and Sinotrack still hold their spots but face challenges maintaining momentum. Meanwhile, Atrack, Traccar, Eview, and Goldstar are closing the gap, hinting at potential shakeups in next year’s rankings. 2025 will be exciting to watch — will these trends hold, or will we see new challengers disrupt the hierarchy? Stay tuned!