Compared to the previous year, in 2023 flespi added nearly ~233,000 devices connected from 89 GPS tracker manufacturers. While the top ten brands classically made up ~90% of that number, we'd like to give a shout-out to all our partners and share more about how they grew and which models have been selected as top picks by our clients.

Disclaimer: This rating is based on our internal data and is not intended to provide an objective reflection of the telematics equipment market. However, it’s worth careful analysis and consideration, particularly for our clients who are technological and IT companies focused on developing advanced telematics and IoT solutions.

Let’s have a closer look at the top GPS hardware manufacturers with a YoY ratio showing how fast they've been growing compared to 2022 dynamics.

10. Atrack

(Ranked 7th in 2022)

Most popular models:

- ATrack AX11 +1,216

- ATrack AS11 +3,820

- ATrack AK11 +738

Atrack grew by almost 6,600 devices (121% YoY) and now amounts to ~20,000 connected units. This Taiwanese brand aims to address industry needs for intelligent solutions in cloud-based asset management but offers numerous GPS trackers for fleet management. Last year Atrack showcased a range of models for asset management, particularly AS500 - a long standby asset tracker, designed for ten years of continuous daily use, and the AK500 telematics gateway for comprehensive data analysis in construction and mining machinery (these two models already summed up in almost 200 devices active).

9. Sinotrack

(No change compared to the 2022 rating)

Most popular models:

- Sinotrack ST-907 +1,066

- Sinotrack ST-905 +1,002

Sinotrack grew by ~7,000 devices (172% YoY) and now amounts to almost ~13,000 connected units. Came to be a dark horse for us in 2022, however, Sinotrack shows steady progress. After all, Sinotrack has 13 years of experience in telematics, boasting 6,000,000+ installed devices and multiple integrations with various software platforms.

8. Topflytech

(No change compared to the 2022 rating)

Most popular models:

- Topflytech TLW2-12B +3,631

- Topflytech TLP2-SFB +1,277

This brand showed impressive annual growth on the platform. Topflytech grew by ~7,000 devices (121% YoY) and now amounts to ~13,200 connected units. They offer a range of devices and services designed to enhance vehicle tracking, fleet management, and other telematics applications. Topflytech's products include GPS trackers with various features such as real-time tracking, geofencing, and advanced data reporting.

7. Calamp

(A newcomer in our rating)

CalAmp broke in with a massive array of ~11,000 connected devices that migrated to flespi - smoothly and seamlessly. The company is leveraging decades of telematics expertise and a customized combination of software, cloud, and edge computing technology. Providing a diverse product line and services encompassing wireless communication devices, tracking solutions, and software platforms we believe it's just the beginning of cooperation.

6. Queclink

(Ranked 3rd in 2022)

Most popular models:

- Queclink GV300W +8,175

- Queclink GV350M +3,862

- Queclink GV50 +2,645

Queclink grew by remarkable ~12,700 devices (63% YoY) and now amounts to an impressive ~53,000 connected units. In 2023 Queclink celebrated a decade of global market presence with the GL300 Series, unveiled a new facility in Vietnam, boosting productivity by 30%, and achieved successful deployment of its devices in the challenging conditions of Antarctica(sic!).

5. JimiIoT (Concox)

(Ranked 4th in 2022)

Most popular models:

- Jimi IoT (Concox) WeTrack2 +5,581

- Jimi IoT (Concox) GT06N +2,943

JimiIoT (former Concox) grew by ~13,300 devices (85% YoY) and now amounts to ~79,000 connected units. The company is one of the world leaders in the design and production of connected devices. Apart from a wide range of cutting-edge telematics devices for vehicles, assets, bikes, people, etc., the company delivers complementary services such as Jimi IoT Hub, TrackSolid Pro fleet management software, Open API, and others. At CES 2024, Jimi IoT/Concox was going to unveil two groundbreaking solutions along with the latest in telematics devices, so let's wait for the upcoming news.

4. Ruptela

(Ranked 5th in 2022)

Most popular models:

- Ruptela Trace5 +10,744

- Ruptela PRO5 +1,824

- Ruptela HCV5 +1,299

In the past year, Ruptela demonstrated significant progress, introducing its Plug5 device and expanding its device support to an impressive 85% of European light vehicles manufactured since 2010 as of mid-June. With a substantial growth of ~13,800 devices, marking a 103% YoY increase, the company now boasts a total of ~50,700 connected units.

Ruptela, a prominent Lithuanian player in transport telematics, has solidified its global presence with 2 million devices scattered across 127 countries, showcasing the popularity of its reliable GPS hardware and the TrustTrack fleet management platform.

3. Suntech

(Ranked 10th in 2022)

Most popular model:

- Suntech ST310U +15,732

Suntech grew by almost ~20,000 devices (578% YoY!) and now amounts to ~28,000 connected units. This South Korean brand offers several quality GPS trackers for fleet management, asset management, and IoT applications and has won particular popularity in South and North America.

2. Coban

(No change compared to the 2022 rating)

Most popular models:

- Coban GPS403-A +9,581

- Coban GPS303-F +7,321

- Coban GPS311 +4,286

Coban grew by ~20,600 devices (73% YoY) and now amounts to ~110,000 connected units. This Chinese brand manufactures numerous basic and advanced GPS trackers for vehicles, motorcycles, e-bikes, pets, people, and assets. The produce is pretty inexpensive, which makes it popular with the wider audience.

1. Teltonika

(Ranked 1st in 2022)

Most popular models:

- Teltonika FMC640 +22,430

- Teltonika FMB920 +13,815

- Teltonika FMC130 +7,129

Teltonika demonstrated substantial growth, with a remarkable increase of ~85,000 devices, representing a 89% YoY growth ratio and ~222,000 connected units total. Teltonika's exceptional performance on the flespi platform can be attributed to its comprehensive offerings, including a diverse range of high-quality GPS trackers.

In 2023 the company celebrated its 25th anniversary, adding a milestone to its successful journey. Teltonika Telematics did mark significant achievements, embarking on the development of an expansive 50-hectare technology park with over ten new facilities. Another noteworthy highlight was the launch of their innovative Fleet Telematics platform, a remarkable evolution of the FMB platform introduced in 2018.

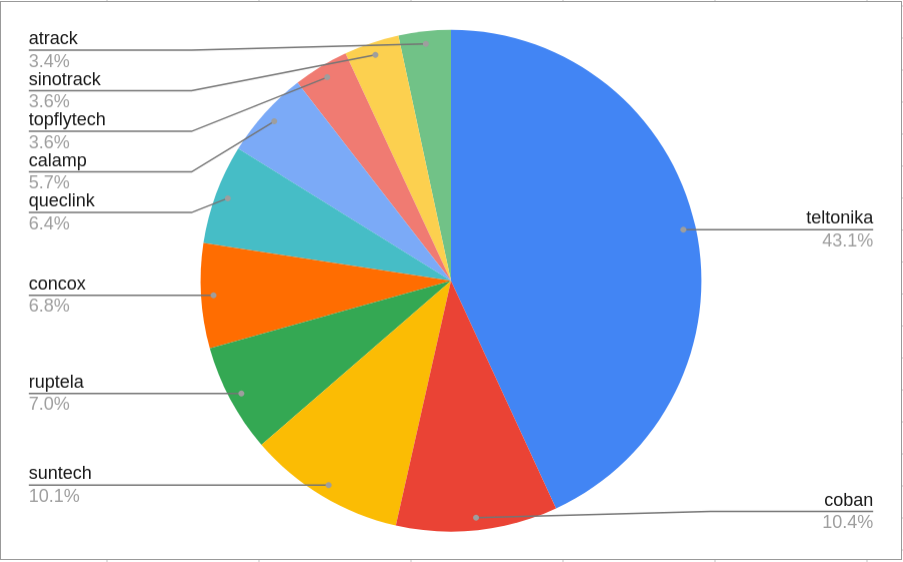

The pie chart presented below illustrates the proportion of overall device growth attributed to each of the top 10 brands.

Summing up

Even though we usually see the same big players in the top 10, it's interesting that only three of them really stepped up their game, and surprisingly, they're not the usual leaders. Our stats are saying, "Don't get too comfy!" While the main crew stays, there's a chance for positions rearranged. Also, we might see some new faces shaking things up with the oldies this year.

Stay tuned!