Understanding insurance telematics

When it comes to priority requirements to a certain solution, they appear to be very domain-specific — for high-load systems, performance might matter most while for the banking industry, redundancy and transaction integrity might of more importance.

Insurance telematics is highly sensitive to time lags and availability — you want the software to never miss any single accident and you want the insured client to always get help in time.

UBI Technologies team develops high-end insurance telematics solutions for the CIS market relying on the experience of the world-leading companies in the field.

UBI Technologies (UBItec) suggested the flespi team to participate in an exciting pilot project in the field of insurance telematics. The task implies collecting, processing, and analyzing large volumes of real-time data from trackers installed on insured vehicles. UBItec needed a rock-solid backend with high performance and high availability since it’s critical to instantly notify insurance companies about accidents happening with their clients, calculate car damage, and take immediate care of human health and lives if necessary.

Immersing into the project

UBItec brings a relatively new notion of usage-based insurance to the CIS. This approach allows insurance companies to optimize their sales model by using the scoring mechanism taking into account the actual driving style and behavior. The insured clients can also benefit from extra telematics-based services offered based on their history — instant notification about damage (accident) and the possibility of compensation, geo-marketing, and more.

The client experience is as follows:

you install a tracker into your car for free

you get a discount if your driving is safe and you do not cause accidents

you get assistance in case of accidents (towing, free taxi, pizza, cinema tickets, whatnot)

you get the compensation for damage to your debit card within an hour (for minor accidents)

insurance company representatives will talk to the road police and will help prove innocence in controversial cases

You get special offers from the partners.

Personalized attitude will increase customer loyalty, and, in the long run, drive up the customer lifetime value.

What makes the UBItec solution stand out is the core algorithms and models — they are built on the basis of enormous volumes of statistical data collected by European insurance companies for more than 17 years (millions of vehicles, billions of miles, hundreds of thousands of real accidents). This provides the best accuracy of insurance scoring on the market, which, in turn, leads to a higher quality of service and higher profitability.

Ensuring eligibility

The key requirements for our platform as a technology provider for the UBItec project were as follows:

1. Universal gateway for communication with various types of equipment — ✔ the platform supports 1000+ tracker models.

2. Support of 500+ thousands of simultaneous connections from telematics devices without performance loss (value based on the expected market growth in the next five years) — ✔ flespi architecture was initially designed to operate with 1,000,000+ connections.

3. High performance (80+K telematics messages per minute) — ✔ all platform components were created from scratch and perfectly fit together to eliminate delays. In addition, flespi develops (and uses) own MQTT broker supporting the latest 5.0 specification that favors high-speed communication. This, in turn, enables instant telemetry processing.

4. High availability — ✔ the service had 99.999% uptime in 2021, which is only 5 minutes of downtime in a year! And it’s with almost daily platform updates.

5. Real-time analytics — ✔ raw data from trackers doesn’t tell much. The value comes from smart aggregation, filtering, and analysis. Flespi can perform these and many other mathematical and logical operations live while also ensuring automatic recalculation upon new data arrival.

Where flespi fits in

flespi is primarily used according to its core competence — as a telematics hub for collecting and processing telemetry data from the GPS trackers installed in the clients’ cars.

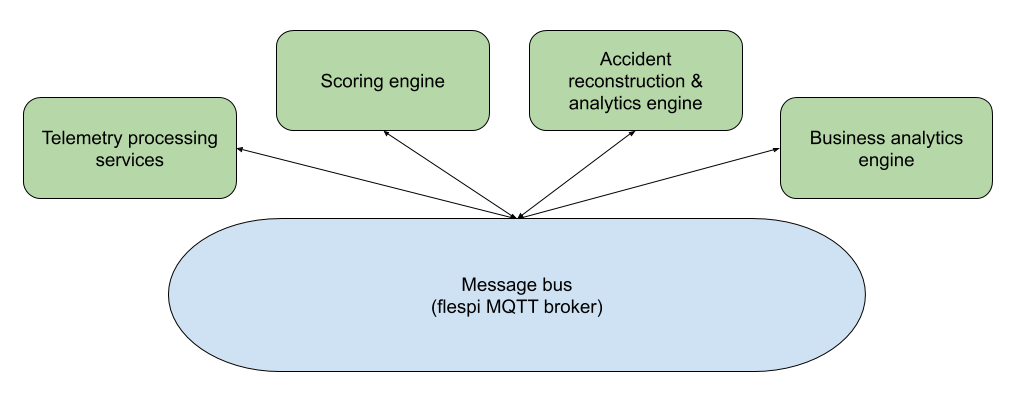

Also, since the different modules of the solution (Telematics engine, Scoring engine, Accident reconstruction & analytics engine, and Business analytics engine) need to communicate with each other as fast as possible, UBI utilized flespi MQTT broker as a central message bus for instant information exchange.

Seamless connectivity with the third-party fleet management platforms natively provided by flespi allows UBItec to extend its product portfolio and offer insurance companies vast monitoring opportunities.

UBItec team is also going to test the potential of the flespi analytics engine in solving the tasks currently handled by the UBI’s own services. Flespi analytics already proved its high performance for some other clients and well-prepared to perform mass calculation and real-time recalculation with the UBItec telemetry data.

What tipped the scales

We asked our colleagues from UBI what factors urged them to stick to flespi as a backend and got the following list:

Pay-as-you-go pricing model allowing gradual growth without redundant investments

High stability & availability required by the nature of the insurance telematics business where every second matters and downtime can ruin the reputation

Guaranteed data delivery ensured by flespi architecture. It’s critical for the solution to get parsed telemetry packages for analysis with minimal delay — since telematics gateway and MQTT broker are the subsystems of the flespi platform, they communicate natively with virtually no lag.

Fast protocols integration on-demand — UBItec mostly uses special Teltonika FMT100 GPS tracker for insurance telematics that they needed to be fully supported

Fast integration with VAS solutions makes it easy to extend the commercial offering with additional services

Fast support and direct contact with the flespi developers' team for qualified assistance on technical issues.

The pilot project that has lasted for a few months proved to be successful — it takes the final solution less than 20 seconds to perform complete accident data processing from initial receipt of parsed data to handling by all the analytics engines and to delivering the calculated damage including information about spare parts and accident severity. As of now, flespi processes the data from several thousand vehicles, instantly analyzes it and delivers to UBItec for business analysis and decision-making. Also, UBI Technologies got a possibility to extend its product portfolio with partner solutions and VAS services, thanks to flespi’s vast opportunities for quick and flexible integration. Fruitful cooperation between UBI Technologies and flespi at the initial stage assured both companies of their technological and commercial match, so they agreed to extend and prolong their joint work on the project.

***

Usage-based insurance is going to experience significant growth in recent years in most countries around the globe since it will align insurance premiums with actual need and boost car-insurance-industry profitability thus favoring both clients and insurance companies.

UBI Technologies company is pioneering the CIS insurance market by effectively grounding on the European best practices and adapting to the local reality and legislation. The use of flespi relieves them from unnecessary distractions from their business focus — device connectivity, integration with third-party platforms, guaranteed stability of the platform infrastructure and internal communication are diligently taken care of. As a result, UBI technologies delivers its solution to the market faster and saves resources on telematics development and infrastructure deployment.