Thanks to global warming, Lithuania is feeling a lot like Slovenia this summer, with super comfortable temperatures ranging from 22 to 28 degrees. Why do people insist on vacationing in the summer months and heading south, straight into the heat, from such a paradise? It’s way better to travel south in the winter or autumn months... But anyway, we’re in peak vacation season, and you can tell not only from our partially empty office but also from the reduced communication with our users.

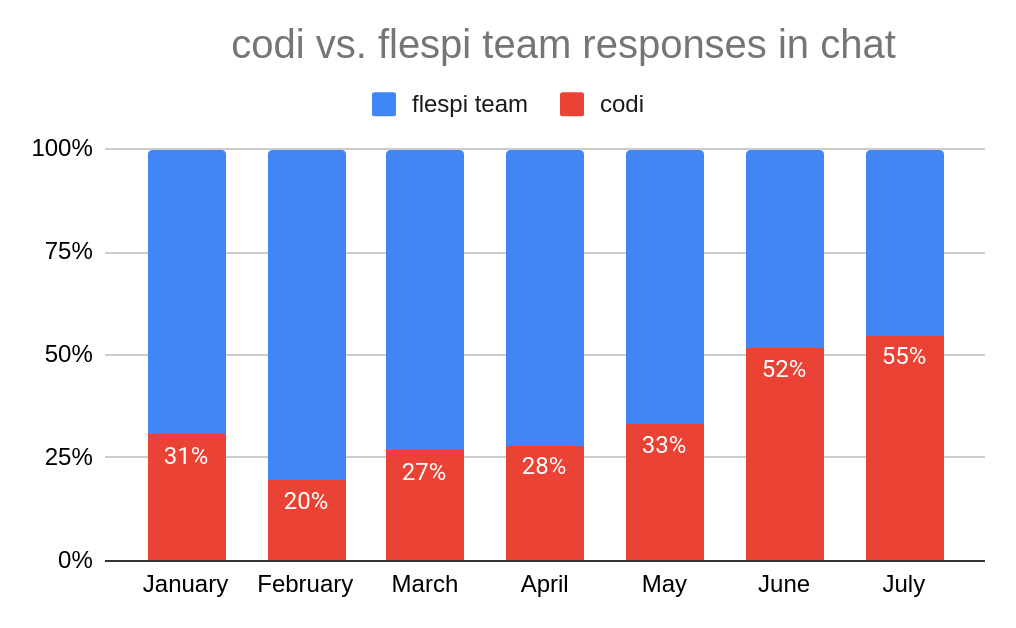

Indeed, the low season is the perfect time to test new functionality for codi—our helpful AI assistant that works non-stop even on the hottest days. In July, it continued its victorious march, handling the majority of our communications compared to our human team members:

It's interesting to see the current trend in financial markets viewing GenAI as an inflated bubble that's about to pop soon. Yet, at flespi, we're already seeing immediate ROI from codi, and it's only set to grow over time.

Running on gen3 architecture—details of which I recently shared on the blog—codi delivers approximately 80-90% of responses that our team considers top-notch. Initiated by users, it's capable of solving complex problems by gathering required information piece by piece from various sources. It's already impressive and gets better every month. The only question left is: what's next?

To explore this question, we decided to throw a BBQ party in the last days of July, giving the flespi team a well-deserved break while codi assists our users in HelpBox.

After a hot talk outdoors and surrounded by nature, we concluded that, at this point in time, we do not yet have a clear vision of what we want with AI—whether it's more or less direct communication with our users, guided (validated by humans) or unguided (fully autonomous) AI assistance. We decided to continue the current AI track mentioned in the roadmap, gather more experience, and return to this question later when we have a more consolidated vision.

In July 2024, our monthly uptime was 99.9945%. We experienced four short downtimes on July 8, totaling 2 minutes. These brief interruptions were due to faulty hardware that froze some operations, and we've already significantly reduced timeouts to detect and handle such non-standard cases more seamlessly in the future.

We invested a significant amount of time in overhauling our storage system. There are numerous improvements in multi-layered storage operations schedulers to enhance processing during peak load times. These improvements are visible only to storage administrators, who can now see how many concurrent requests are being processed with zero impact on the system.

Also, we moved containers and CDNs from the “internal” subsystem to a user-space layer and enriched these storage elements with our standard features—metadata, recursive access with subaccounts, and grants.

For devices, we added an enable/disable switch, a handy function for temporarily blocking message reception from devices for some reason.

Finally, we implemented streaming telematics data to Apache Pulsar Broker and made multiple protocol parsing enhancements.

We're on the brink of hitting our first million registered devices, possibly within the next month, given the current pace. I'm thrilled to share some stats on the top device manufacturer brands that fueled our growth in the first half of 2024.

The most popular choice of device manufacturer in flespi, without any doubt, is still Teltonika. In the first 6 months of 2024, it contributed to 38.2% of all new devices registered in flespi.

Second place, with a 14.5% share of new devices, is now occupied by Suntech, which is the leading device brand for flespi in South America.

Jimi IoT (Concox) is in third place, with an 8.2% share of new devices.

Next is Queclink, securing the fourth spot with a 5.6% share.

The fifth place is held by Coban, which has contributed to our device growth by just 4.1% so far in 2024.

All top four brands have improved their standings compared to 2023, both in relative and absolute terms. Coban is the only brand losing its presence, slipping from second to fifth place.

Statistics indicate that flespi users are shifting toward more advanced applications, demanding greater hardware functionality. While vehicle telematics still dominates other verticals, the focus is now on complex solutions, fleet optimization, BLE sensors, CAN bus, and EV data gathering, rather than just simple track and trace. This is a trend I wholeheartedly welcome.

Enjoy the last month of summer!