This post comes with plenty of numbers, but let’s start with the main one: we’ve connected around 400k devices from 130+ GPS tracker manufacturers – and are now well past the 1.5m devices milestone overall.

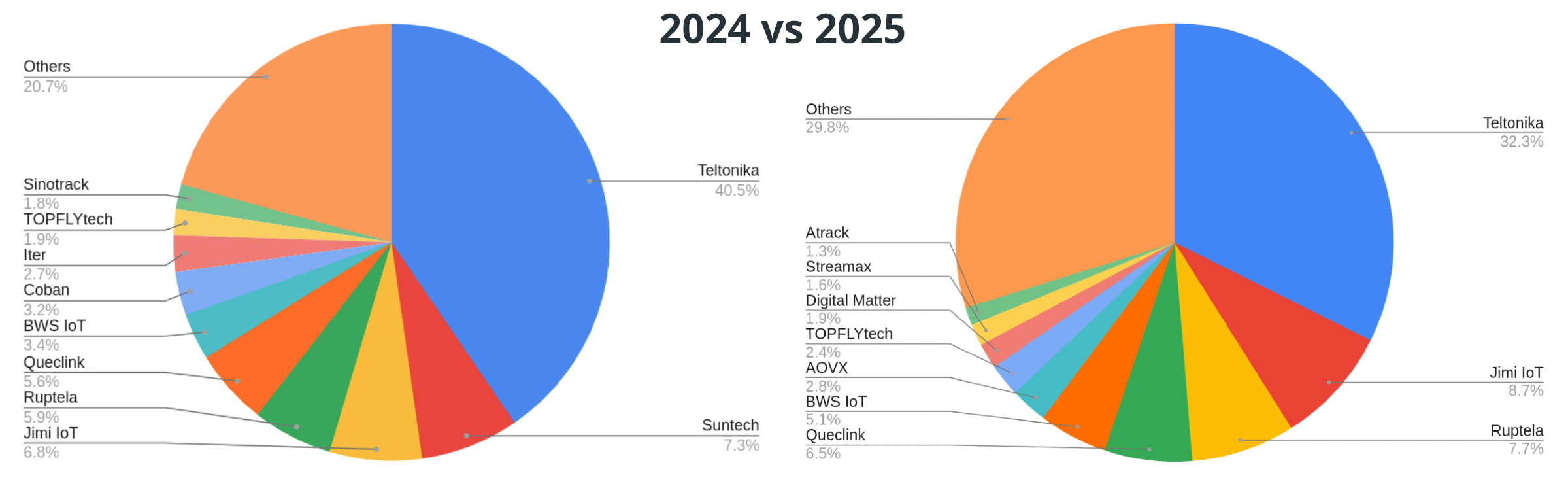

Back in 2023, the top ten brands collectively accounted for around 90% of the total. A year later, their share dropped to nearly 80%, and in 2025, we can round it down to 70%. This clearly signals intensifying competition: while the market leaders still dominate in absolute numbers, they are being gradually challenged by less “loud” brands. So, let’s break down the list and review their YoY growth ratios to see how fast they’ve been scaling – just like we did last year.

Disclaimer: This ranking is based on our internal data and isn’t meant to provide a fully objective reflection of the telematics hardware market. That said, it offers valuable insights for our clients – especially technology and IT companies aiming to build advanced telematics and IoT solutions.

10. Atrack

Most popular models:

After three years outside the chart, Atrack finally made a comeback – connecting 5k+ devices to flespi and pushing Sinotrack off the 10th spot. Throughout the year, AS500 was actively deployed across the US and Canada as a replacement for legacy 3G systems, offering a modern 4G option (LTE Cat. M1) for monitoring heavy machinery and containers. During the year, the Taiwanese manufacturer introduced its own lineup of wireless temperature and humidity sensors, with a clear focus on pharmaceutical logistics, where high reporting frequency and measurement accuracy are critical.

9. Streamax

Most popular model:

AD plus 2.0 +3,606

The first newcomer on this year’s list, Streamax, added 6k+ new devices. A long-awaited entry that reflects both the growing adoption of feature-rich dashcams and the overall rise of video telematics. Streamax continues to hold one of the strongest positions in the commercial transport segment, maintaining a leading share in the mobile DVR (MDVR) market. The company is rolling out impressive technologies like ADAS/DMS 2.0 – upgraded algorithms that now detect not only fatigue or phone usage, but also microsleep and even “cognitive distraction.” Another example is BSD (Blind Spot Detection): new blind-spot monitoring cameras can classify objects (pedestrian, cyclist, scooter) and trigger different types of warnings. In addition, the manufacturer announced solutions for integration with truck onboard control systems, enabling active braking in critical situations – reportedly in collaboration with OEM vehicle makers.

8. Digital Matter

Most popular model:

Barra GPS +3,547

Another company which finally made its way to the chart – this time from Australia. Known for long battery life devices, Digital Matter predictably stood out with its asset tracker designed to deliver up to 8 years of battery life (nearly every second unit among the ~7.8k devices connected to our platform during the year). One of the company’s key milestones was the launch of models featuring 5G NTN (Non-Terrestrial Network) capabilities. The Oyster Edge (Satellite Edition) – an updated bestseller – can automatically switch between terrestrial networks (NB-IoT/LTE-M) and satellite connectivity through partnerships with providers such as Skylo. This effectively solves the “dead zone” issue in deserts and oceans, making satellite connectivity accessible for standard shipping containers and construction equipment. Another noteworthy development is Battery Life Prediction: the device management platform now includes an AI tool that predicts battery depletion dates with up to 95% accuracy, based on real-life conditions such as temperature, signal quality, and reporting frequency.

7. TOPFLYtech

(Ranked 9th in 2024 and 8th in 2023)

Most popular models:

TOPFLYtech climbed two positions, adding almost 10k devices (168% YoY ratio) after a modest 83% in 2024. It’s great to see the growth rate stabilizing – and also to see a new model taking the top spot. In 2025, the company almost entirely refreshed its product portfolio, focusing heavily on LPWA (Low Power Wide Area) technologies. The compact TLW2-6SC with magnetic installation became a logistics hit thanks to its combination of LTE Cat. M1 and Bluetooth 5.0 for connecting various wireless sensors.

6. AOVX

Most popular model:

GL100 +10,632

More than 11k devices connected to flespi, but the 6th position is secured thanks to a single model – a highly successful asset tracker supporting GPS, BeiDou, Wi-Fi, and a wide range of other positioning technologies. Strategically, AOVX has focused less on vehicle tracking and more on intelligent cargo sensors. For example, the company introduced impact and drop analysis algorithms capable of distinguishing natural transportation vibrations from critical damage events. The manufacturer also upgraded its platform with risk forecasting tools – such as spoilage alerts based on temperature trend dynamics over the last few hours.

5. BWS IoT

(Ranked 6th in 2024, most popular model: unspecified)

BWS IoT made an impressive entry last year – and this time doubled their result, adding 21k devices (201% YoY ratio). Specializing in advanced telematics for logistics and fleet management, in October 2025, the manufacturer opened its second factory in Brazil to meet growing regional demand for IoT devices. Add to this a strategic partnership with SIMCom for innovative LTE and LPWA solutions, and it becomes obvious that this ranking is no coincidence. The company also launched the BWS NB2 IoT mobile tracker, compatible with 4G, 5G, and even future 6G networks – suggesting an incredibly long lifecycle of 20–30 years.

4. Queclink

(Ranked 5th in 2024 and 6th in 2023)

Most popular models:

Queclink grew by ~27k devices this year, reaching an impressive 156% YoY ratio after 135% in 2024. With approximately 97k connected units on our platform, the company continues to bet on portfolio diversity – yet this year our list of top models is almost a reverse mirror of last year’s ranking. In terms of releases, the manufacturer delivered on its promises, launching the GV75MG SAT satellite tracker, introducing the WR310 5G router, and rolling out the flagship CV5000 – a multi-channel AI dashcam that processes data directly on-device via Edge AI. Queclink also significantly expanded its partner network across Europe, Latin America, and India, where the manufacturer has sold over 100k units in just 1.5 years after entering this new market.

3. Ruptela

Most popular models:

Last year, we labeled Ruptela as the company of “Steady Growth” – and it finally climbed into the top three. With nearly 32k new devices and a remarkable 176% YoY ratio (even higher than the 130% achieved in 2024), Ruptela continues to strengthen its position. The company reaffirmed its reputation as an expert in vehicle data acquisition: in 2025, its supported vehicle database (including EVs and specialized machinery) exceeded 1,500 models, one of the strongest figures in the industry. The Smart5 release clearly targets small and mid-sized businesses that need reliable CAN data reading on a limited budget. The manufacturer remains committed to its “Quality First” strategy – unlike competitors betting on mass-market pricing.

2. Jimi IoT (Concox)

(Ranked 3rd in 2024 and 5th in 2023)

Most popular models:

Jimi IoT confidently reached 2nd place, adding almost 36k devices and delivering a 173% YoY ratio, outperforming the 155% recorded in 2024. With nearly 135k connected units overall, the company clearly gained renewed momentum. Notably, while other models are picking up traction, they still have a long way to go to match the popularity of the legendary GT06N. Strategically, Jimi IoT made a strong bet on AI-powered video telematics. New dashcam models replaced the JC400D – namely the JC261 and JC371, both equipped with ADAS and DMS. Another growth area was its Attach-and-Go Cold Chain Solution for rapid temperature monitoring deployments, along with a lineup of solar-powered GPS trackers designed for long-term autonomous tracking in remote environments.

1. Teltonika

Most popular models:

The undisputed leader for the 4th year in a row. Teltonika added around 134k devices, although its YoY growth slowed down compared to the previous period (144%) and landed at 109%. With almost 480k connected units, the company continues to set the highest bar in telematics. September marked a major milestone: Teltonika Group, together with AGP Investments, opened 4 new factories in the Vilnius High-Tech Hill Technology Park (€320m invested), acquired a security systems manufacturer now operating as Teltonika Security Systems, and continued developing the FT platform while introducing the FTx880 and FTx305 devices.

Summing Up

Who’s gone: Suntech, Sinotrack, Iter, and – as expected – Coban. The chart below shows a core group of consistent participants, while the bottom 3 positions remain a “battle zone,” periodically taken by companies previously unseen in the ranking. But this doesn’t mean that all other manufacturers will scale evenly outside the top ten. Of course, we’d love to see not only steady YoY growth from the main cluster, but also new names strong enough to secure a permanent place in the ranking. Notably, the Others segment increased from 20.7% to 29.8%, which means market leaders won’t be able to relax.

Our forecast: 2026 will bring even tougher competition – sometimes all it takes is one successful model, more aggressive marketing, or a well-timed deal. On the other hand, we’re especially curious to see how the Jimi IoT vs. Ruptela rivalry plays out. Either way, it’s a peaceful fight for market share – so it feels symbolic that our chart resembles a peace sign. :)